Our Speakers

Keynote Speaker

V S Sundaresan

Executive Director - SEBIMr. Sundaresan has more than 30 years of experience in Securities Market. He is presently heading the Information Technology Department and Market Regulation Department of SEBI.

As Head of Information Technology, his responsibilities include monitoring the Cyber Security of SEBI as well as the securities market, IT infrastructure and application software development of SEBI.

As Head of Market Regulation, his responsibilities include monitoring the functioning of the stock exchanges, depositories and clearing corporations.

His past assignments include formulation and enforcement of regulations on raising of capital, corporate restructuring, trading, clearing and settlement, risk management, registration and supervision of intermediaries, market surveillance and investigation.

He has delivered 400+ lectures within India and 25+ lectures in overseas seminars, on varied topics related to securities market.

Sundaresan is a graduate in Commerce, holds Post Graduation in Finance and Human Resources and a degree in Law. He is also a Certificated Associate Member of Indian Institute of Banking and Finance.

Leading Speakers

Speakers are listed in alphabetical order of their last name.

Vaisshali Babu

Managing Director & CEO - BSE Clearing House – ICCLMs. Vaisshali Babu has assumed office as the Managing Director & CEO with effect from January 1, 2024.

Previously, Vaisshali was the Chief Operating Officer and Chief Risk Officer of the Company.

Vaisshali is a capital market veteran with overall capital market experience of over 30 years spread across BNP Paribas, BofA (ML), State Street, SHCIL, United India Insurance Co Ltd., and Mumbai Port Trust. Her area of expertise is in clearing house operations, custodian business, products and relationship management, operations management, project management including risk, compliance and audit. Vaisshali is very active in various industry groups and has worked closely with Indian regulators on topics related to the development of Indian capital market. She has the credentials of articulating key regulatory changes e.g. foreign investments in India, improving settlement efficiencies, debt market investments etc.

Vaisshali holds a master’s degree in commerce from Mumbai University with a business administration qualification from Symbiosis. She has credentials of executive programmes from IIM Bangalore, IIM Rohtak and IIM Calcutta and is member of Institute of Directors. She was recognised as “India’s top 100 women in Finance” by AIWMI in 2019 and awarded “Best in Custody” at the Women in Finance Asia Awards in 2022.

Complete believer in changing society via children’s education – actively associated with few NGOs.

Her professional mantra is “Be Simple Be Different”.

Balaji Balasubramanian

Partner - Tax & Regulatory Services – Financial Services - Price Waterhouse & Co LLPBalaji Balasubramanian is a Partner at Price Waterhouse & Co LLP, based in GIFT City. He focuses on Financial Services clients of the firm.

Balaji advises Foreign Portfolio Investors, Banks and Funds from a Tax & Regulatory perspective, specifically on their India entry strategy and platform set-up. Balaji has advised on large Banking/Non-banking M&A transactions in India. He has worked on platforms relating to niche banking & capital markets projects both in the Indian mainland and Gujarat International Finance Tec-City/ International Financial Services Centre.

Balaji is part of industry delegations discussing with Indian regulators and tax authorities on evolving policy matters.

Rajib Ranjan Borah

Co-founder and CEO - iRage Broking Services LLPRajib is the Co-founder and CEO of iRage Broking Services LLP, an Indian clearing & broking firm engaged in institutional broking & high-frequency proprietary trading. He also co-founded and serves as Director of QuantInsti, a globally recognized leader in quantitative trading education.

At iRage, he focuses on proprietary trading strategies development, business growth initiatives, risk management processes, and operations optimization. A global speaker at algo trading conferences, he serves on advisory committees at all three major Indian exchanges.

His career spans roles at Optiver (High-Frequency Trading in European and US markets, Amsterdam), PwC (Strategy Consulting), Bloomberg (Equity Derivatives Research, New York), and Oracle (Business Intelligence).

A national Olympiad finalist, he has represented India three times at the World Puzzle Championship. Rajib also serves as visiting faculty in finance at IIM Ahmedabad & IIT Bombay. He holds a bachelor's degree in Computer Engineering from NIT Surathkal, and a post-graduate degree in management from IIM Calcutta.

.jpg)

Rathiesh Chandran

Head of Trading - Premji InvestHave spent last 20 years across Buy and Sell side firms on the trading side.

Aniruddha Chatterjee

MD & CEO - NSE CogencisAniruddha Chatterjee brings about 25 years of experience in the information and analysis industry and has held several leadership roles across leading companies and successfully led business growth and transformations. Prior to joining NSE Cogencis in 2022, Aniruddha was with Refinitiv (erstwhile Thomson Reuters Financial & Risk business and now a part of London Stock Exchange Group), where he has served first as Head of Buy Side and Exchanges and thereafter as Market Leader Account Management for Key and Strategic accounts across South Asia. Aniruddha also served as the regional sales director at Dow Jones for six years and led the growth of its regulatory risk & compliance business in India. He spent over a decade working with India's premier economic think tank CMIE leading sales, business development and also led the company’s pioneering effort to start India's largest primary survey of households. Aniruddha also had a stint with Bloomberg as Team Leader and was recognised for developing the company’s buy-side sales strategy in the region.

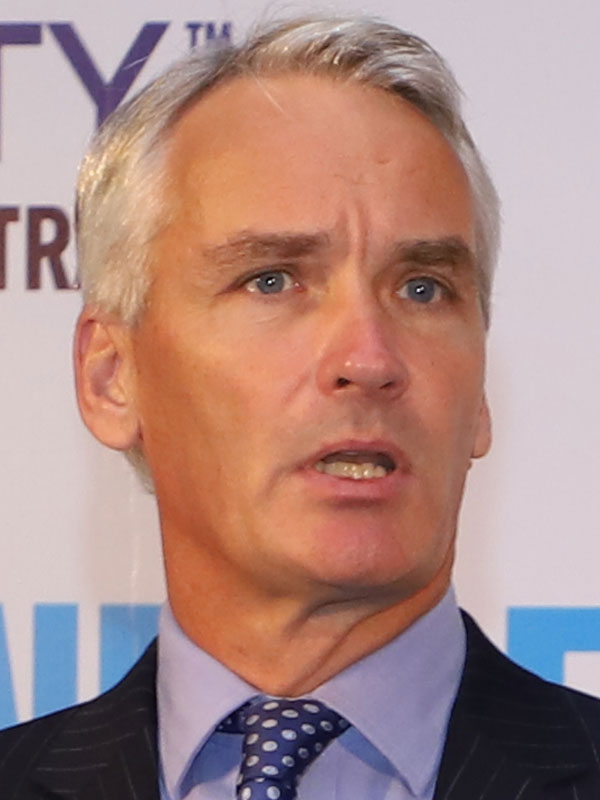

Matt Cretney

Head of Product Management - Beeks GroupMatt Cretney is an experienced technologist with over 25 years in FinTech, infrastructure, and network analytics. Before joining Beeks, he spent a significant portion of his career at Reuters and Refinitiv, where he led the technical product development of Refinitiv’s SaaS multi-tenant white-labelled FX eTrading platform. He also played a pivotal role in evolving Refinitiv’s FX Matching Service, overseeing its transition to cable equalization, colocation deployments, and ensuring compliance with MIFID II regulations.

Now leading Product Management at Beeks, Matt focuses on bringing cloud agility to the financial markets, enhancing business visibility into infrastructure performance, and driving the adoption of high-performance analytics for trading environments. His expertise spans low-latency infrastructure, high-frequency trading (HFT) technologies, and real-time analytics, making him a key voice in the evolution of market access, competition, and liquidity.

Khyati Dalal

Leader, Corporate Transaction, Private Equity and M&A Practice - Nishith Desai AssociatesKhyati is currently working as a leader in the Private Equity and M&A Practice of the research and strategy driven law firm, Nishith Desai Associates. She has been actively involved in representing some of the leading global private equity / venture capital funds, across a wide range of mid-size to large transactions, involving investments into India and cross border acquisitions. She has represented several private equity funds, pension funds, sovereign wealth funds and alternative investment funds in their structured debt deals in Indian companies including non-banking financial companies. She specializes in securities and foreign exchange law including FDI/FPI structuring, overseas investment laws, and compliance with SEBI and RBI rules and regulations. She is also a chartered accountant and prior to completion of law, has worked at PricewaterhouseCoopers during the period 2017-2019 in the transactional tax and regulatory team.

Anshuman Das

Managing Director and Chief Technology Officer - JM Financial ServicesAnshuman Das is MD and Chief Technology Officer of JM Financial Services, the retail brokerage arm of JM Financial. JM Financial is one of the top Investment Bank of India.

He recently moved out from the role of CIO of Sharekhan post its acquisition from BNPP to Mirae Assets. Prior to that he was the CTO at Edelweiss Global Markets where he managed the Algo and HFT trading business. Before that he was with Citigroup, where he was instrumental in bringing the first global HFT players to NSE. He also led the India development team for low latency Global Market Access and was the global lead for unified cross asset pre-trade risk system. He is an MBA from the Indian School of Business, Hyderabad and also holds a Bachelor’s and Master’s degree in Engineering from the Indian Institute of Technology Delhi.

Suryadeep Das

CFA

Director, Electronic Trading Services (ETS) - Kotak Institutional EquitiesSuryadeep heads the Electronic Trading business in Kotak Institutional Equities.

He has more than 15 years of experience in sell-side Institutional Equities – primarily in Electronic Sales Trading – with a background in Equity Research, Quant Research and APAC Equity Risk & Facilitation.

Prior to joining Kotak, he was a part of Deutsche Bank’s APAC Electronic Sales Trading Team.

He has a B.Tech in Electrical Engineering from IIT Madras, a PGDM from IIM Ahmedabad and is a CFA charterholder.

Pankaj Dhake

Electronic Sales Trader – Morgan StanleyPankaj has ~12 years of experience in the financial industry with varied roles in Hong Kong and India from arbitrage trading, systematic trading, market microstructure and electronic sales trading. Pankaj looks after the Electronic Trading in India for Morgan Stanley. He started his professional work experience with a 3-year stint as a Delta-one trader with UBS Hong Kong where he was involved in statistical arbitrage of HK-China ETFs. He then developed medium frequency systematic trading signals in the US and European equities for ~1.5 years as a senior quantitative researcher with Worldquant, subsidiary of Millenium Partners. Post this he had a ~7 years stint with CLSA as part of the market microstructure team and Electronic trading team. He has a stellar academic record with a Gold medal in academics from IIM-Bangalore.

Joy Francis

Director – Global Markets, Electronic Trading Sales - APAC - UBSJoy Francis is part of the APAC Electronic Product Sales Team, driving efforts for SEA & India, and is based in Singapore.

His work involves providing an understanding on algorithmic capabilities and suitability in line with APAC microstructure, as well as best execution.

Before moving to Singapore, Joy lead the India Electronic Trading Desk for UBS, based out of Mumbai. Prior to joining UBS, he was Head of the Electronic Trading business for ICICI Securities in India.

Joy holds a Bachelor’s Degree in Commerce from Mumbai University and an MBA in Finance from ICFAI.

With an interest in numismatics, Joy is keen collector of old coins and has a passion for experimental cooking.

Anil Ghelani

CFA

Head of Passive Investments & Products - DSP Mutual FundAnil has been working with DSP Group since 2003. The DSP Group has a legacy of from than 150 years, making it one of the oldest and most respected financial services firms in India. He is currently Head of Passive Investments & Products. Previously, he served as the CEO & Chief Investment Officer at DSP BlackRock Pension Fund Managers. Earlier in his career at DSP, he led the Risk and Quantitative Analysis team providing quantitative research inputs and buy-side credit research on companies across various sectors.

Prior to joining DSP, Anil worked at IL&FS Asset Management Company and at S.R. Batliboi a member firm of EY.

He has been a volunteer with the CFA Society India for more than a decade and has served as the Vice Chairman on the board.

Koel Ghosh

Executive Director, India Client Coverage - MSCIKoel Ghosh is currently Executive Director, Head India Client Coverage for MSCI Inc. to lead the strategic direction in expanding MSCI’s regional market presence and provide innovative industry-leading, research-enhanced solutions to the market, enabling clients in the investment community with critical decision support tools and services.

She has over two decades of deep experience in the financial industry with an extensive background in strategic initiatives and a proven track record in driving revenue growth having served as the CEO of Asia Index Pvt Ltd and Head of South Asia at S&P Dow Jones Indices. In these roles, she spearheaded growth, market share expansion, and brand visibility through strategic business planning and stakeholder engagement. She played a pivotal role in launching S&P 500 derivatives in India and expanding business operations in South Asia. She has been instrumental in building the Indian passive market with the success with the Employees Provident Fund initiating investments in ETFs, launching Bharat22 Index, a government disinvestment index, and being a passionate advocate for the space. Her career also includes significant positions at Thomson Reuters, UTI Asset Management, and IL&FS Asset Management, coupled with a strong foundation in audit from PricewaterhouseCoopers, showcasing her financial acumen and strategic leadership in the industry.

A qualified Chartered Accountant, she is a distinguished leader in the financial industry, recognized among the Top 100 Women in Finance and currently serving as the Chapter Lead for Women in ETFs, India Chapter.

Jay Prakash Gupta

Founder - Dhan (Moneylicious Securities Pvt Ltd)Mr. Jay Prakash Gupta is The Founder of Dhan (Moneylicious Securities Pvt Ltd), a technology platform for super traders and long-term investors.

Mr. Gupta has held senior positions at India’s leading retail brokerage houses like Indiabulls, and Karvy. He has been among the early leaders in the Online Broking space in India and has been instrumental in building the E-Broking business at Karvy.

An Alumnus of IIM Ahmedabad, Jay has over 20 years of rich experience in the financial services and capital markets. Currently, Jay is the National Vice President of Commodity Participants Association of India (CPAI) and he also serves on the Advisory Committee of NSE and MCX.

Mr. Gupta is a known face in the Broking Industry and features regularly as a Guest on leading business channels like CNBC Awaaz and other media houses.

He was conferred as India’s Best Analyst – Commodities Fundamental category in the year 2014 by Shri Narendra Modi and in the year 2016 awarded the Zee Excellence Award in the year 2016 by Shri Piyush Goyal, Union Minister, Power, Coal, Mines and Renewable Energy at the Zee Market Analyst Award.

Elwin Jose

Head of Product Strategy and Services - NSEElwin Jose is responsible for managing Product Strategy and Services at NSE, India. In this role, he heads the product development strategy and the services verticals, for the suite of products available on NSE. He is a senior product and client solutions expert with significant experience in Capital markets, having worked in all areas related to the Equity and Derivatives markets, including Trading platforms, new product development, risk management and client clearing solutions.

Prior to NSE, Elwin was the Head of Product for Futures and Options, India at Deutsche Bank, where he managed the Futures and Options business for Deutsche Bank in India.

Jennifer Karkala

Director, Chief Information Security Officer (CISO) - BNP Paribas IndiaJennifer is the Chief Information Security Officer (CISO) of the India Branch of BNP Paribas based in Mumbai. She has been with BNP Paribas for more than 6 years and has been in the Indian financial services industry for more than 20 years in various risk and control management roles. She is a Chartered Accountant by education and a certified CRISC professional. In her career, she has handled roles related to Cybersecurity and various other risk management aspects - IT Risk, Regulatory Risk and Operations Risk. In BNP Paribas India she is responsible for the management of IT Security and Cybersecurity matters and ensuring compliance with various IT-related regulatory requirements.

Prashant Kedia

Electronic Sales Trader – Vice President - Jefferies India Private LimitedPrashant brings two decades of experience in institutional equities, specialising in electronic sales trading within the Indian market.

As Vice President at Jefferies, he leads electronic sales trading in India, offering execution consultancy and market insights to institutional clients while enhancing trade execution and platform efficiency.

Before joining Jefferies, Prashant held key roles at Goldman Sachs and Macquarie Capital contributing to the growth and development of their electronic trading business.

Winnie Khattar

Head of APAC Advocacy, BlackRock Global Markets - BlackRock Asset ManagementWinnie Khattar is APAC Head of Advocacy for BlackRock Global Markets (BGM). BlackRock Global Markets (BGM) is at the core of BlackRock's markets and investments platform, and includes index investing, global equites & fixed income trading, securities lending, liquidity and financing. As head of BGM advocacy, Winnie helps our teams deliver strategic market outcomes by advocating for policy and market structure reform, education and industry engagements; leveraging her capital markets experience and BlackRock's leading investment platform insights. Winnie is also the co-chair for BlackRock’s Women’s network in Hong Kong.

Prior to this, Winnie was Head of Market Structure for ETF & Index Investing (EII), at BlackRock. Prior to BlackRock, Winnie worked at BofA Securities, and Deutsche Bank in Hong Kong, London and Mumbai. Winnie is a passionate positive person, who enjoys outdoors, trail running, sailing and community initiatives both inside and outside work.

Pramod Koyothi

Co-chair of India Working Group - FIX Trading Community, andExecutive Director, Global Banking & Markets – Equities - Goldman Sachs

Vijay Krishnamurthy

Managing Director and Chief Executive Officer - India INXShri. Vijay Krishnamurthy is Managing Director and Chief Executive Officer of India International Exchange (IFSC) Limited (India INX).

Before joining India Inx, he was heading the debt segment at BSE Limited. In earlier stint he has also worked as Additional Director with CRISIL Limited.

He has rich and vast experience of over 20 years in investment research and products across asset classes, with an expertise in Fixed Income markets. He has also worked closely with regulators and institutional clients for the development of capital markets in India.

He has been instrumental in leading the development and implementation of Request for Quote (RFQ) platform, security level valuations, debt/debt hybrid indices for the Indian markets. His active participation and contribution in several SEBI committees/sub-committees/working group has helped in shaping up some of the policies for debt markets and indices Close.

Shri. Vijay is academically sound, with qualification in PGDBA- Finance and Marketing and a Commerce Graduate from Mumbai University.

Sriram Krishnan

Chief Business Development Officer - NSESriram has over 29 years of work experience in the Indian banking and capital markets space. He has spent about 22 years with multinational organisations, across corporate and institutional banking, asset management and securities services at various levels of seniority.

His current role with the NSE, as Chief Business Development Officer, entails establishing and managing business strategy and advocacy, product lifecycle and all business alliances and relationships. Sriram also oversees marketing & corporate communication and economic policy & research.

In his previous roles, Sriram has worked for over 21 years across HSBC, Citi and Deutsche Bank. In his immediately previous role with Deutsche Bank India, Sriram was Managing Director & Co-Head of Global Transaction Banking.

Sriram is a qualified Chartered and Cost Accountant from India.

Sharath Kumar R N

Co-founder & CEO - 5-SwansSharath is the Co-Founder & CEO of 5-Swans a quant trading and consulting firm. Sharath, a veteran with over 25 years in BFSI, has co-founded and helped scale multiple algo-trading startups for proprietary trading and institutional money management.

Sharath has a Bachelor’s Degree from IIT Kharagpur, India and is a former Managing Director and CEO of Tower Research Capital India, prior to which he worked in various leadership roles across global banks (like ABN AMRO, Barclays Capital, Nomura) with a strong focus on building scalable enterprise quantitative trading systems.

Edward Mangles

Regional Director, Asia Pacific - FIX Trading CommunityEdward Mangles has helped support The FIX Trading Community’s Asia Pacific committee for over 20 years, playing a key role in promoting institutional trading standards and FIX adoption across the region, and facilitating cross-industry collaboration. In March 2009, Edward was appointed Asia Pacific Regional Director for the FIX Trading Community, and works closely with the buyside, sellside, regulator, exchange and technology provider members of the institutional trading community to support efficient trading.

Viral Mehta

Lead, Private Equity and Financial Services Regulatory Practice - Nishith Desai AssociatesViral has over 25 years of experience, specializing in private equity, mergers and acquisitions, foreign investment, takeovers, dispositions, privatizations and joint ventures. Viral has advised Governments, sovereign funds, private equity funds, multinational companies, social impact funds, financial institutions and non-banking financial companies.

Before joining NDA, Viral became the first ever lateral partner at S&R Associates, and previously, he co-headed A&M Law Offices. Prior to that, he worked at P&A Law Offices in Mumbai and New Delhi. Viral has authored a book on private-placement transactions titled “Private Placement of Shares: Deal-making and the Madisonian Dilemma” (OakBridge Publishing, 2022).

Vinata Mhatre

Director, Asia Pacific Electronic Trading - BofA SecuritiesVinata Mhatre has been with Bank of America Merrill Lynch over 20 years. Her primarily responsibility is Electronic Sales & Coverage for India market. She has been associated with FIX Trading Community India Working Group for over 10 years.

Shekhar More

Director – Electronic Trading Services - Spark Institutional Equities Private Limited (“Avendus Spark”)Shekhar leads the Electronic Trading business at Avendus Spark. With over 15 years of experience in sell-side Institutional Equities, he specializes in Electronic Sales Trading, leveraging his expertise in Electronic Engineering, Trading Technologies, and Algorithm Analytics.

Prior to joining Avendus Spark, he was a part of the Electronic Sales Trading team at Nuvama Wealth Management.

Soniya More

Senior Equity Trader – IKIGAI Asset ManagerSoniya More is Equity dealer of IKIGAI Asset Manager with effect from September 9, 2024.

Previously, Soniya was the Chief Manager – Investment of Kotak Life Insurance for 3 years. She has more than 19 years’ experience in the stock market. She received the KLAP Award from Kotak Life for demonstrating a supreme level of commitment in Equity dealing in 2024.

Soniya has completed her graduation from D.G.Ruparel College & PG – Finance from K C College. She has completed ‘Executive Programme in Algorithmic Trading’ (EPAT) from QuantInsti. She is a ‘Certified Alternative Investment Manager’ from the Association of International Wealth Management of India.

Kunal Nandwani

Co-founder and CEO - uTrade SolutionsKunal is a tech entrepreneur, co-founder and CEO of fintech - uTrade Solutions.

Kunal has worked with Lehman Brothers, Nomura and BNP Paribas in London.

He holds a bachelor’s degree in computer science from PEC (India) and MBA from ESSEC (Paris). Kunal is also an author and angel investor.

Govind Patnaik

Co-chair of India Working Group - FIX Trading Community, andVice President – Trading - Franklin Templeton

Govind is primarily responsible for Execution of Equity Trades and manages electronic trading and Algo wheel within the desk. Govind joined Franklin Templeton in April 2006 and was heading Global Trading Analytics team in Hyderabad until 2015. Govind relocated to Chennai in 2015 to assume trading role in the India Trading Team. He is also Co-chair of the India Working Group of the FIX Trading Community, and is part of ASIFMA India Working Group (Asia Securities Industry & Financial Markets Association). Prior to Joining Franklin Templeton, Govind was with Fidelity Investments in their Retirement Services Division. Govind has MBA in finance and has Investment Foundations Certificate from CFA institute. He has over 20 years of experience in Asset Management and Financial Services Industry.

Dr. Tirthankar Patnaik

Chief Economist - NSETirthankar Patnaik is Chief Economist at the National Stock Exchange of India. He has over two decades of experience in the Indian capital markets, academic research, credit research in macro and sector strategy, quantitative finance, and consumer banking. At the National Stock Exchange, he leads research efforts in macroeconomics, financial markets, corporate governance & ESG and market microstructure. The Economic Policy Research team is responsible for NSE’s flagship publication, the Market Pulse.

Dr Patnaik started his career as a researcher at the Indira Gandhi Institute of Development Research (IGIDR) and worked on a number of academic and corporate projects in econometrics and quantitative finance, followed by a stint in consumer banking analytics as an analyst with the Global Consumer Group of Citibank in India and Europe. His next focus area was equity strategy for institutional clients, initially with Citigroup Global Markets as India equity strategist, and then with Religare Capital Markets Ltd, as the India Strategist and Chief Economist. In his last assignment prior to joining NSE, he was the Chief Strategist and Head of Research for India, at Japan-based Mizuho Bank.

Tirthankar has a PhD from the IGIDR, Mumbai, where his area of research was high-frequency finance and market microstructure. He also has an MSc in Statistics, and a BSc in Mathematics, both from the University of Madras. He considers himself fortunate to have had a ring-side view of the growth story of the Indian economy and markets over the past two decades.

Brian Pomraning

Chief Product Officer, Trading & Connectivity Solutions - BroadridgeBrian Pomraning was appointed Chief Product Officer for Trading and Connectivity Solutions at Broadridge in September 2024. In this role, he spearheads the global product management organization, overseeing the full suite of trading and connectivity products and services. His focus is on driving innovation and enhancing client offerings in the rapidly evolving fintech landscape.

Previously, Brian held senior leadership positions at Investment Technology Group, J.P. Morgan, Barclays and Lehman Brothers as well as financial technology firms Pico Trading, Exegy and Elwood Technologies. With over 25 years of experience in the financial services industry, Brian has a strong background in product management, sales, and technology.

Brian's extensive expertise in electronic trading and product development positions him as a key leader in advancing Broadridge’s strategic goals in capital markets trading.

Vishtaspa Rana

Head - Equity Trading - 3P Investment ManagersVishtaspa Rana is currently working with 3P Investment Managers (AIF Category III) as Head - Equity Trading. He has earlier worked with TATA Mutual Fund as Trader for their Mutual Fund and AIF Schemes.

He obtained his graduate diploma in Business Administration from S.I.E.S College of Management, and Bachelor Degree in Commerce from University of Mumbai.

Alastair Richardson

Strategic Business Development Director - AMDAlastair brings more than two decades of experience in the global fintech and networking technology sectors. His journey spans roles across the front office, technical leadership, and various domains, including trading, product development, and sales. Alastair has worked at renowned financial institutions such as JP Morgan, Credit Suisse, and Barclays, as well as several fintech startups focusing on capital markets, including Fixnetix and Metamako. Currently, he spearheads Global Business Development for Financial Technology at AMD NTSG.

Sandeep Sabnani

Product Strategy and Growth, Equities - ION MarketsSandeep is a seasoned expert in Product Strategy and Growth, Equities at ION Markets with over 18 years of experience in FinTech and SaaS domains.

Sandeep’s career spans various key engineering and product leadership roles at ION and Ericsson. His expertise lies in product management, strategy, and growth, where he excels in building client relationships, leading cross-functional teams for business expansion, and delivering innovative solutions in the dynamic financial and regulatory landscapes.

Drawing on his engineering background, Sandeep combines strategic insights to achieve impactful outcomes. Passionate about entrepreneurship, growth and innovation, Sandeep is committed to creating value for users and partners alike, always striving for quality and excellence in his endeavors.

Sandeep holds a Master’s degree in Information Security from the University of London and a Bachelor’s degree in Computer Engineering from the University of Mumbai.

Manan Vaishnav

CAIA

Director & Head - Societe Generale Securities IndiaManan is the Head of Societe Generale Securities India & is responsible for spearheading the growth of the company.

He has 20 years of experience at marquee investment banks, such as Deutsche Bank, CLSA & Goldman Sachs as a Sales Trader for India Listed Derivatives. During this time, Manan has served some of the largest systematic long/short derivatives trading hedge funds based out of Hong Kong & Singapore. In his current role, Manan is working closely with the exchanges & clearing corporations and is an active member of Broker Industry Standards Forum.

Manan holds a master’s degree in economics from the MS University of Baroda, a master’s degree in business administration from Indian Institute of Management Indore, and a CAIA Charter from the US-based Chartered Alternative Investment Analyst Association. He has built a strong community of followers on LinkedIn, where he talks about topics related to finance & careers apart from mentoring undergraduate students, early & mid-career professionals. He liaises with some of the top b-schools in India for providing career guidance workshops to its MBA students. His work can be found on https://www.linkedin.com/in/manankv.

Rohan Vartak

APAC Relationship Manager - ITRS GroupRohan Vartak is the APAC Relationship Manager at ITRS Group, bringing over 20 years of unique experience in IT operations and sales leadership within capital markets. He has managed mission-critical IT teams, spearheaded the transition to agile, supported real-time infrastructures, and partnered with financial enterprises in their Operational resilience projects. Rohan is a recognized thought leader and frequent speaker at leading industry events across APAC.

.jpg)

Amit Vavle

Vice President, Electronic Sales Trading - Bernstein IndiaVice President - Electronic Sales Trading at Bernstein in Mumbai - India. Nearly 2 decades of Industry experience across Domestic & Global Sell Side’s with good hold on Electronic & Algorithmic Trading, FIX Protocol, Equities & Derivatives Front office, Middle office Technologies.

More speakers to be announced.