Our Speakers

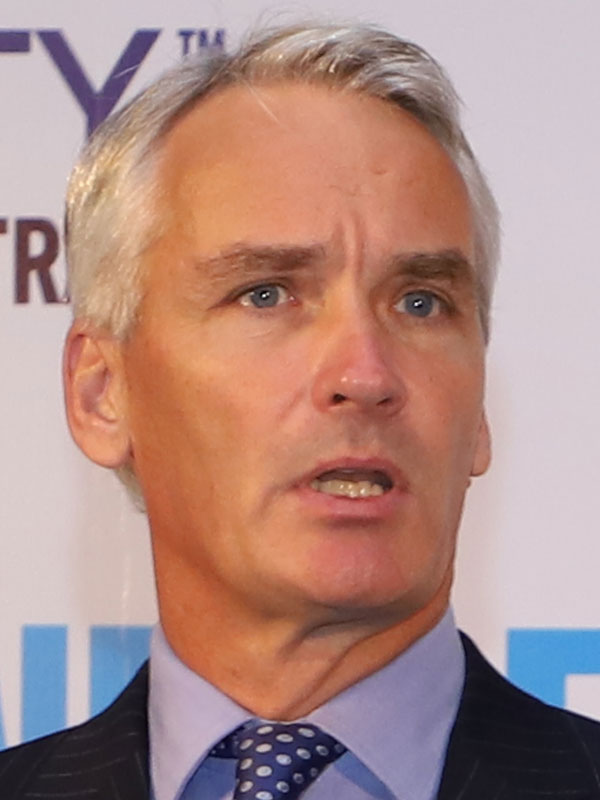

Brett Backhouse

Head of Portfolio Implementation - Rest SuperBrett Backhouse is the Head of Portfolio Implementation at Rest Super, a role he has held since May 2022. Brett brings over 34 years of trade execution and portfolio management experience in financial markets, with a proven track record in leading high-performing teams and delivering strong business and client outcomes. Known for his disciplined approach and collaborative leadership style, Brett is responsible for overseeing multi-asset class trading, risk management, and the implementation of portfolio strategies to support Rest Super’s investment objectives.

Prior to joining Rest Super, Brett held senior positions across several leading financial institutions. He served as Head of Market Operations and Risk at Yieldbroker, where he led process improvements to reduce operational risk and enhance efficiency. Brett was also Head of Exposure Management and Dealing at BT Investment Management, playing a key role in establishing robust trading and risk control environments, and delivering significant transaction cost savings for client portfolios. Earlier in his career, he held leadership roles at BT Financial Group and NM Rothschild & Sons (Australia) Ltd, gaining deep expertise in fixed interest, equities, derivatives, and treasury management.

Brett holds a Master of Applied Finance from Macquarie University, where he was awarded prizes for both Strategic Marketing and Ethical Risk in Finance. He also holds a Diploma in Financial Markets from the Securities Institute of Australia.

Brett’s enduring market reputation is underpinned by his strong business ethics, effective stakeholder management, and commitment to innovation and operational excellence.

Robb Baiad

Director, Sales & Trading - GTNRobb Baiad currently works for GTN based in Seoul and covers Korea, Taiwan, HK and Australia as Director of Sales and Trading. His coverage is mostly institutional clients including Long Only, Long/Short and Prop Desks offering access to over 80 markets including 24/5 US trading. Prior to GTN, Robb was one of the founding employees of Blue Ocean ATS based in Singapore then Korea and was tasked to create demand in Asia to trade the US Market. He built the US overnight trading business from its infancy to seeing over $3B notional a night being traded on the ATS. He previously worked for a RE Asset Management firm as Head of Investments.

David Barrett-Lennard

Head of Execution Services Australia - LiquidnetDavid started at Liquidnet in 2019 to build out an Australian Execution Services desk. He is responsible for the low/high touch trading, client coverage and involvement in product development for the execution platform. Prior to Liquidnet, David held a sales and trading role at ITG.

David holds a Bachelor of Science from Sydney University, a Masters in International Business from the University of Wollongong and a Masters of Applied Finance from Macquarie University.

Eugene Budovsky

Co-Chair, Australia Working Group - FIX Trading Community, andExecutive Director, Equities - Goldman Sachs

Eugene Budovsky is an electronic equity execution specialist with expertise in sales, trading, connectivity, regulatory compliance, and product development. Eugene's past roles include Head of Equity Execution Platforms at Barrenjoey, and Co-head of Credit Suisse’s AES electronic execution business for APAC.

Eugene has over 18 years of front office experience in Asian equities with roles covering electronic execution, portfolio trading, facilitation, D1 sales and ETF market making.

William Buttigieg

Head of Trading - CitigroupWilliam Buttigieg runs Citigroup’s Australian Trading desk with particular focus on Delta One & ETF products. Will is responsible for providing liquidity to Institutional clients across a variety of Delta One products with a particular focus on ETFs, Futures and Swaps.

Prior to joining Citigroup in 2022, Will ran the Delta One trading desk at UBS in Sydney from 2008 through 2022.

Mark Collett

Vice President - ETF Capital Markets – BlackRockMark Collett is a member of the APAC ETF Capital Markets team at BlackRock, within the Global Markets & Index Investments (BGM) group. He plays a key role in protecting and growing ETF trading by enhancing the ETF ecosystem, managing relationships with market makers and exchanges, and collaborating with industry partners. His team oversees daily primary market activity and secondary market quality for all APAC-domiciled listed ETFs, while also delivering market insights, engaging clients on ETF trading and implementation, and scaling education across the ecosystem.

Prior to joining BlackRock, Mark was a Product Manager at Global X ETFs, focusing on the development and maintenance of the firm’s product suite. He also held roles at the Australian Securities Exchange (ASX) as an Investment Product Specialist and Senior Trading Operations Officer.

Mark holds a Bachelor of Economics from Macquarie University in Sydney.

Carole Comerton-Forde

Professor of Finance – University of MelbourneCarole has been researching the global exchange industry for over 20 years. Her research in market structure examines how the mechanics of the market, such as regulation and technology, impact prices, liquidity and trader behaviour. Her research covers equities, corporate bonds and Exchange Traded Funds. Current research interests include dark pools, fragmentation, the connection between the cost of raising capital and secondary market liquidity and the evolution of public and private markets. Carole’s research has been published in the leading finance journals including the Journal of Finance and the Journal of Financial Economics.

Carole previously held academic positions at UNSW Business School, Australian National University and University of Sydney, and visiting positions at New York University and the London School of Economics and Political Science. She was also Visiting Economist at the New York Stock Exchange. In addition to her academic role, she has been an economic consultant for the Australian Securities and Investments Commission and is an Academic Advisor to the Plato Partnership in Europe. She also consults with market participants, stock exchanges, market regulators around the world.

.jpg)

Kate Cooper

CEO – OKX AustraliaKate is a transformational leader with over 20 years of global experience at the intersection of technology, strategy, and leadership. She has a proven track record of helping organizations navigate paradigm shifts—first with the rise of Web 2.0, where she played a pivotal role in digital transformation for major global brands and governments, and now with the proliferation of Web3, where she is shaping the future of financial services.

Kate’s career has spanned executive roles in both traditional finance and digital assets. Most recently, she led APAC operations at Zodia Custody, a bank-backed institutional digital asset custodian, where she drove growth, regulatory alignment, and industry collaboration across five markets. Before that, she held senior positions at National Australia Bank, where she was instrumental in the bank’s digital asset strategy.

Her expertise in regulatory strategy and digital transformation is well recognised - she was previously the UK government’s first-ever Head of Social Media, played a key role in Lego’s turnaround by harnessing online communities, and helped Toyota recover from a global recall crisis through large-scale digital engagement across 32 countries.

Kate is also a board member of the Digital Economy Council of Australia (DECA), actively shaping the country’s digital asset policy landscape.

Rory Cunningham

Senior Manager, Investment Products – ASXRory Cunningham is a Senior Manager, Investment Products at ASX, working within the Listings and Markets group. He leads business initiatives to expand the range and adoption of investment products listed on ASX, including Exchange Traded Funds (ETFs), Listed Investment Companies and Trusts (LICs/LITs), Real Estate Investment Trusts (REITs), Warrants, and Retail Debt Securities.

With over 15 years of experience in Australia’s investment and financial markets, Rory brings deep expertise across the funds management ecosystem. His previous roles at Fidelity Investments and Perpetual Investments have equipped him with a strong foundation in asset management and investor engagement.

Rory holds a Bachelor of Commerce (Accounting and Finance) and a Master of Business Administration from the University of Sydney.

Oran D’Arcy

Head of Listings, Asia Pacific Region - CboeOran D’Arcy is Head of Listings, APAC at Cboe Global Markets, Inc. (Cboe). He is responsible for the strategic development of Cboe’s Listing business in the region, which includes Exchange Traded Products, Warrants and Corporate Listings.

Oran is an established leader with extensive experience in product development and distribution, funds management and securities lending in Australia and across Europe. He joined Cboe Australia in 2021 having previously held roles at ASX, Macquarie, Citigroup & Merrill Lynch.

Oran holds Master of Business Administration from Central Queensland University.

Sagar Desai

APAC Head for Wholesale Client Business – Coinbase InstitutionalSagar Desai is focused on building Coinbase’s institutional client solutions and leading strategic relationships across Asia, Australia, and the UAE. In this role, Sagar is also the head of APAC for Coinbase's wholesale client business, which includes banks, asset managers, introducing brokers, exchanges, financial technology firms, and other institutional market participants.

Prior to joining Coinbase three years ago, Sagar was the head of Investment Solutions for InvestaX, a Singapore-licensed platform for securities token offerings, where he led a Monetary Authority of Singapore-awarded Proof-of-Concept product to tokenize private markets investment fund structures like Singapore's Variable Capital Company.

Sagar started his career in institutional asset management at Goldman Sachs, where he was responsible for new business development and revenue generation efforts from sovereign wealth funds, pensions, and endowments in Singapore, Brunei, South Asia, Vietnam, and Timor-Leste. He was also one of the 10 global members nominated to the Junior Advisory Board for Goldman Sachs' Investment Management Division.

Sagar earned an BBM in Finance from Singapore Management University in 2013 and the UniFi by CAIA™ Digital Assets Microcredential in 2023, in addition to completing the Wharton Executive Education course on Economics of Blockchain and Digital Assets in 2022.

Richard Galvin

Executive Chairman and CIO – DACMRichard is the Executive Chairman and CIO of DACM. Richard founded DACM in 2017, bringing with him more than 20 years’ experience working in senior investment banking roles including at JP Morgan and Goldman Sachs. Richard is a thought leader and global commentator on the evolution of digital assets and the long-term investment opportunities in this new asset class. As the Executive Chairman and CIO of DACM, Richard applies unique investment skills to provide sophisticated and institutional investors access to professionally managed digital asset portfolios.

Danielle Gerace

Senior Country Officer, Australia – BroadridgeBased in Sydney, Danielle Gerace has been appointed Senior Country Officer for Australia at Broadridge in 2025. In this role, she leads the firm’s business strategy and senior client engagement in the Australian market, bringing extensive capital markets expertise and industry leadership to help clients achieve growth and transformation. Danielle originally joined Broadridge in 2023 as Head of Client Service, Australia, where she focused on strengthening executive client relationships and delivering service excellence.

She brings over two decades of global experience across banking, market infrastructure, and financial technology. Prior to joining Broadridge, Danielle held senior leadership roles at Northern Trust, including Global Product Lead for Capital Markets and Head of Market Advocacy and Innovation Research, APAC, where she worked closely with industry bodies, regulators, and governments to drive market reform and support clients’ adoption of next-generation operating models.

Earlier in her career, Danielle held a variety of executive roles, including General Manager of Clearing Services at the Australian Securities Exchange (ASX), Principal Consultant to the Australian Securities Industry at Kairos Enterprises, and CEO of Berndale Securities, a subsidiary of Bank of America Merrill Lynch. She has also held senior positions in Prime Brokerage and Capital Markets at Bank of America Merrill Lynch and BNP Paribas, and began her career with PwC, specializing in financial services audit across Sydney and Bangkok.

James Giarratano

VP, Head of Sales - CboeJames Giarratano is VP, Head of Sales, Cboe Australia at Cboe Global Markets, Inc. (Cboe), responsible for growing the firms Cash Markets business in Australia. With over 20 years of electronic trading experience, he has a proven track record of driving strategic growth and building high-impact partnerships through identifying opportunities, fostering client relationships, and executing strategies that propel organizational success.

Prior to joining Cboe in 2022, James held senior roles at BNP Paribas, Deutsche Bank and KCG across New York, Sydney, and Hong Kong.

Giarratano graduated cum laude from the University of Massachusetts, Amherst with a BA in Economics and has held professional licenses with FINRA and the SFC.

David Jenkins

Chief Technology Officer – ImpactX MarketsDavid’s career in digital product and technology has spanned 30 years, and he has held executive positions in global technology organisations such as Pepperstone, Bloomberg, Thomson Reuters, Fidessa and Liquidnet. For the past 20 years David has been solely focused on the capital markets with experience spanning across asset owner, fund manager, broker/dealer and exchange. He is active in industry bodies such as Fintech Australia and FIX Trading Community and held the FIX co-chair position in APAC for two years, and co-chair of the regulatory and exchanges sub-committee for seven years.

Most recently David was the Chief Product and Technology Officer for Pepperstone Group, a global retail broker offering crypto and derivatives margin trading. He is now working with the Digital Finance CRC on increasing the allocation of capital to impact investments, through commercialisation of an impact investment framework aimed at issuers in private markets, ImpactX Markets.

David holds a B.S in Commerce/Information Technology from James Cook University which he received in 1994.

Phil Joslin

Head of APAC - ScilaPhilip Joslin, founder of Grimaud, is recognised across Asia’s financial and strategic consultancy space for his unique bridge-building between East and West. With early career foundations in Europe, particularly in the trading, clearing, and exchange ecosystems - he brought that depth of expertise to Asia starting in 2009, when he relocated to Singapore to help establish Eurex’s regional presence.

Over more than two decades, he has navigated both Western and Asian markets with fluency, giving him a rare perspective that informs Grimaud’s services today.

Philip is frequently invited to share his insights on panels and roundtables alongside APAC thought leaders, where he weighs in on trends in financial markets, regulation, innovation, and cross-border strategy. His presence among those leading voices underscores his standing in the field and his ability to articulate how global market forces intersect with Asian market dynamics.

He has been working with Scila since April 2022 and was recently appointed Head of APAC.

Dylan Kluth

Head of Equities Trading, AsiaPac – Macquarie Asset ManagementDylan is the Head of Trading for Macquarie Asset Management (MAM) in the Asia-Pacific region, based in the Sydney office. In this role, he is responsible for the operation and risk of the trading desk, executing trades in the APAC region on behalf of all equity investment teams and managing a team of high-touch and systematic traders. He also manages the Sydney based Portfolio Services Group team, which focusses on portfolio implementation for equities teams in AsiaPac.

Prior to his current role, he was a Portfolio Manager/Analyst on the Global Listed Real Estate team.

Before joining the firm, Dylan was the Global Head of Multi-Asset Trading for AMP Capital based in London.

He holds a Bachelor of Science in economics from Texas A&M University.

Jason Lapping

Head of International Equity Trading - DimensionalJason Lapping is Head of International Equity Trading at Dimensional, overseeing a team of 12 traders based in London, Singapore and Sydney. In this role, he manages trade execution strategies and coordinates trading operations across the firm’s international trading desks of equities, FX & Futures in support of its equity strategies. His focus is on ensuring the firm's execution strategies and technological infrastructure meet the highest standards.

Dimensional is the world’s largest active ETF provider, and Jason plays a key role in working with Dimensional Australia’s Capital Markets team to ensure effective trading across the ETF line-up.

Jason joined Dimensional in 2010 and brings deep knowledge and experience of global markets. Prior to Dimensional, Jason spent 14 years at Societe Generale, where he led the equities derivatives division, in London, Paris, Hong Kong and Australia.

Jessica Leung

Portfolio Manager - Global X ETFs, and Representative - Women in ETFs APACJessica Leung is a Portfolio Manager at Global X ETFs, responsible for fund management and product development. Jessica works across Global X’s full suite of products including equity, thematic, commodities and fixed income. Prior to joining Global X ETFs, Jessica has worked at BetaShares and Macquarie Asset Management, and has over 12 years of industry experience. Jessica holds a Bachelor of Actuarial Studies and Bachelor of Applied Finance at Macquarie University.

Rachael Lucas

Head of Marketing & Communications - BTC MarketsRachael Lucas is an experienced marketing and communications leader with over 15 years in commercial and retail sectors. As Head of Marketing and Communications at BTC Markets, Australia’s leading digital asset exchange, she shapes the company’s strategic brand direction, media presence, and customer engagement. Her work has significantly enhanced the exchange’s national profile and strengthened its position within the fintech ecosystem.

Previously, Rachael was National Senior Marketing Manager at CBRE, the world’s largest commercial real estate and investment firm, where she led national campaigns and delivered measurable ROI across multiple business lines.

Her interest in blockchain began in 2019, evolving into a deep passion for digital assets. She is an active crypto trader and technical analysis enthusiast, with a strong belief in blockchain’s potential to reshape the global economy. Rachael holds a Bachelor of Applied Science from RMIT University and is a skilled stakeholder manager with a sharp eye for market trends.

A regular media commentator on crypto and regulation, Rachael has appeared on Bloomberg, Sky News, AFR, The Age, and Ausbiz. She also serves on the Women of Digital Economy Council of Australia (WoDeca), advocating for diversity and inclusion in the blockchain and fintech sectors.

Gus Mackay

Director, APAC Sales and Product Development - 24 Exchange BermudaGus has spent 30+ years building and scaling trading businesses across FX, Crypto, and now US Equities. From Sydney to Singapore, New York to London, he’s helped reshape how markets are delivered—bridging regions, streamlining workflows, and pushing tech to the forefront.

He led the rise of electronic NDF in London, built cross-border NDF infrastructure in New York, and helped launch 24X Crypto OTC offering across APAC. Now, he is part of the drive to rollout Overnight US Equities. Bringing near 24-hour access to the world’s deepest equity market.

With 24Exchange securing the first SEC license for round-the-clock trading, Gus is helping global participants rethink how and when they can trade.

Edward Mangles

Regional Director, Asia Pacific - FIX Trading CommunityEdward Mangles has helped support The FIX Trading Community’s Asia Pacific committee for over 20 years, playing a key role in promoting institutional trading standards and FIX adoption across the region, and facilitating cross-industry collaboration. In March 2009, Edward was appointed Asia Pacific Regional Director for the FIX Trading Community, and works closely with the buyside, sellside, regulator, exchange and technology provider members of the institutional trading community to support efficient trading.

Mark Monfort

Co-Founder - NotCentralisedMark Monfort is a finance and technology leader at the forefront of Australia’s digital asset and AI transformation. He is Co-Founder of NotCentralised, where he advises institutions and startups on the practical adoption of blockchain and AI technologies across finance and other industries. Mark’s recent work includes building compliance-focused blockchain solutions, enhancing investment analytics platforms, and leading the development of digital tools that support real-world asset and data tokenisation.

Mark is also President of the Australian DeFi Association, where he leads industry initiatives connecting traditional financial institutions with emerging technologies, engaging with government and industry bodies on policy, and building public-private partnerships to drive innovation.

Previously, Mark held roles at Canaccord Genuity and QMG Insights in London, focusing on investment analytics and macroeconomic research across the capital markets ecosystem. Mark also worked at the ASX upon his return to Australia.

Mark is widely recognised for his ability to bridge the gap between finance and technology, championing the responsible adoption of blockchain, digital assets, and AI to deliver business value, improve transparency, and unlock new opportunities for Australia’s financial markets.

Roshan Nandwani

Portfolio Manager - VanguardBased in Melbourne, Roshan Nandwani is currently a Portfolio Manager at Vanguard Investments Australia, working within the Equities Index Group for the last seven years.

Prior to joining Vanguard, Rosh served as a Director at Deutsche Bank in various equity trading roles, including Electronic Trading, High Touch/Blocks and most recently led the Program Trading desk in Hong Kong – giving him extensive experience across APAC equity markets.

He holds a Bachelor of Arts in Finance and Accounting, from Regents Business School, London.

Yemi Oluwi

Co-Chair, Australia Working Group - FIX Trading Community, andPrincipal Business Analyst - Nasdaq

Yemi has over 25 year’s experience in financial markets technology, specialising in electronic trading. Currently a Principal Business Analyst at Nasdaq working on matching engine solutions. Previous roles at exchange operators include responsibility for the operation and technology strategy of the NSX, and solution analysis and FIX expertise at several projects within ASX. With experience on electronic trading solutions at brokers such as Deutsche Bank and UBS, and other participants within the market, Yemi has a wide range of experience to draw on.

Mary-Anne Peril

Head of Execution Services, Australia - Virtu FinancialBased in Sydney, Mary-Anne oversees Virtu’s Execution Services in Australia. She shares her insights and expertise in executing high-touch, electronic and program trades for our institutional buy- and sell-side clients, based both locally and offshore.

Mary-Anne joined ITG in 2004–prior to the firms’ 2019 acquisition by Virtu Financial.

Mary-Anne holds a Bachelor of Arts, with majors in Mathematics and Statistics from The University of Melbourne, and a Master of Applied Finance, majoring in Financial Markets, from Kaplan Professional.

She won the Excellence in Sell-Side Trading Award at the 2020 Women in Finance Asia Awards.

Aaron Pryce

General Manager – Asia - Rapid AdditionAaron is the General Manager - Asia, for Rapid Addition, a provider of high-performance enterprise trading technology to capital markets firms around the globe. Rapid Addition is recognized as an industry leader and pioneer in financial messaging protocols.

Having re-joined Rapid Addition in June 2019 as part of the company’s growth strategy, he has established operations in the Asia-Pac region.

Aaron was an early practitioner and participant in the FIX protocol from 2001 with Salomon Brothers and Citigroup where he delivered client connectivity services to European trading firms. Subsequently he worked with FIX Protocol to extend the design of the protocol to support the exchange trading models of the LSEG and Bolsa Mexicana de Valores.

Other experience spans technology in areas such as commercial banking risk, EDI, unmanned fuel stations, and retail charge cards. In his spare time, he enjoys backcountry hiking, trout fishing, and the occasional craft beer.

Emma Quinn

President - CboeEmma Quinn is President, Cboe Australia at Cboe Global Markets, Inc. (Cboe). A proven leader with significant experience in global capital markets, she is responsible for defining and executing the company’s strategy and increasing adoption of its products and services. Quinn also serves as Cboe’s regional lead for APAC, fostering a unified culture and driving coordination across the region.

In 2023, Quinn joined Cboe from AllianceBernstein, where she was Global Co-Head of Equity Trading. Previously, she served as head of Asia-Pacific Trading, head of Asia-Pacific Fixed Income and Australia Equities Trading, and head of Trading for Australia and New Zealand for the firm. Prior to joining AllianceBernstein in 2001, she worked as an equity trader at AMP Henderson Global Investors.

Quinn also provides strategic leadership and participation on a number of boards and committees to help drive innovation and influence industry development. She is currently a Director and Chairperson of FIX Protocol Limited and FIX Protocol Trading Limited boards, as well as a member of Chief Executive Women in Australia. She was previously an advisory board member of Quorum 15; a member of the Markets Advisory Panel for the Australian Securities and Investments Commission; a member of Asia Trader Forum; and a member of various Asia Securities Industry & Financial Markets Association committees.

Quinn holds a Bachelor of Business in finance and business law from the University of Technology, Sydney.

David Rabinowitz

Head of Global Index Analytics and Asia Pacific Market Structure – UBSDavid Rabinowitz is Head of Global Index Analytics and Asia Pacific Market Structure.

David started his career at SBC Warburg in 1997, where he assisted in designing and implementing Warburg's European Equity Research database. After a brief stint at Paribas, he moved to Hong Kong to rejoin UBS Warburg Dillon Read in 2000, as a member of the award-winning Asian Quantitative Analysis team. David then moved on to the Asian Portfolio Trading team between 2004 and 2008 before leading the Asian electronic trading desk over the past decade, managing the rollout and expansion of UBS' DMA and Algorithmic strategy platform throughout Asia. David relocated in 2018 to Sydney where he continues to oversee regional market structure and emerging market access, driving exchange and regulatory trading initiatives whilst concentrating on building benchmark and bespoke beta solutions for global clients.

Enza Raffa

Senior Trader - ClearBridge InvestmentsEnza is an equity dealer and works within the Investment team. She is responsible for implementing trades with a dual responsibility for minimising transaction costs and maximising implementation efficiency.

Prior to joining a predecessor firm in March 2002. Enza previously worked at Alliance Capital, AXA and National Mutual.

Enza’s significant tenure of over 20 years, and broad experience within the Australian equity market, has allowed her to shine a light on how trading is an integral part of the investment process. She believes in working closely with the team to achieve the best outcome for clients and enjoys the challenge of leadership and teamwork for success. Enza also believes in championing women in finance, especially in the trading role.

Sam Shteingart

Product Manager - BloombergSam Shteingart is a product manager at Bloomberg, where he leads the development of Rule Builder (RBLD), Bloomberg's multi-asset automated trading solution. With a strong background in automation, transaction cost analysis, and trading algorithms, Sam has a proven track record of driving innovation in the financial technology space. Prior to Bloomberg, he worked at Flextrade, ITG, Solomon Brothers and Goldman Sachs. A graduate of Binghamton University's Computer Science program, Sam is also a prolific inventor with multiple patents in trading technology.

Dr. David Snowdon

Dr. David Snowdon has been engineering low-latency systems since 2009, first for a trading firm, then as a vendor. Since founding Metamako in 2013, he has worked to transform the way financial services networks are built, developing and popularising Layer 1 switching, pioneering the use of FPGAs for low-latency networking and productising ultra-precise, ubiquitous, packet-level monitoring. Since being acquired by Arista, Dave has headed up their efforts toward low latency, FPGA-based switching, and their FPGA development platform. Dave works across all levels of the technology stack from hardware, through gateware/FPGA to software, devops and product management. Prior to a life in financial technology, Dave was awarded a PhD for work in Operating Systems, focussing on power management. His work with solar powered racing cars has given him an uncompromising approach to optimisation across multiple disciplines – an approach he now applies to the trading systems he builds.

Rob Talevski

Chief Executive Officer - Webull Securities AustraliaRob Talevski is Chief Executive Officer of Webull Securities Australia which is the Australian entity of global self-directed investment powerhouse Webull. Webull currently operates in 15 countries and continues to expand delivering technology driven wealth and investment solutions to millions of global users.

During his time at Webull, Rob has overseen the development of seamless mobile app lead access for Australian retail and intermediary investors to some of the biggest capital markets in the world. And has proudly introduced to retail investors a number of ‘first of its kind’ investment services in Australia as well as consistently been an early adopter of new global investment technologies.

Rob has over 20 years’ experience in local and international markets with a particular focus on electronic trade execution across retail, wholesale and institutional channels. Prior to Webull, Rob has held senior roles at several of Australia’s leading retail and intermediary brokers.

Clare Witts

Head of APAC Equity Market Structure - J.P. MorganClare Witts Head of APAC Market Structure at J.P. Morgan, working with clients and across the bank’s equity trading desks. Her role includes assessing the impact of regulatory and policy trends and analysing how that affects the microstructure of the equity markets and improving trading outcomes. Clare has worked in Asia for over 15 years in a variety of roles that help combine big picture trends with actionable trading insights. As well as over 10 years working in electronic trading at investment banks and agency brokers, she has worked in cross-industry functions including as Chair of the FIX Trading Community, as the Asia Chair for Quorum 15, the think tank for buy and sellside heads of trading; and as Director of Government and Regulator Relations at CFA Institute representing key topics for the investment management industry to regional policymakers.

Greg Yanco

Former Executive Director of Regulation and Supervision - ASICMost recently Greg was CEO of the Australian Securities & Investments Commission where he previously held Executive Director roles for Markets and Regulation & Supervision overseeing all the entities that ASIC has responsibility for.

Greg has more than 35 years experience as a markets and financial services executive and regulators.

Before joining ASIC Greg was the CEO of AXE ECN Pty Limited. Prior to that Greg was responsible for institutional and wholesale markets at the Australian Stock Exchange (now Australian Securities Exchange) where he implemented equity market structure changes and managed the operation of the market surveillance and investigation units.

Amanda Zeller

Senior Executive Leader, Market Integrity - ASICAmanda leads the Market Integrity team, which is responsible for the regulation and supervision of corporate finance transactions and markets surveillance. This includes overseeing listed companies’ conduct and disclosure in public capital raisings, and mergers and acquisitions, as well as leading ASIC’s work in derivatives and equities surveillance.

Amanda has held other senior roles at ASIC including leading the Supervisory Cyber Resilience Program for ASIC regulated entities. She holds a Bachelor of Commerce and is a member of CPA Australia.

More speakers to be announced.