Gaye Anable

Gaye AnableGaye leads Saxo’s Institutional Business in Australia and is responsible for the Prime, Liquidity and Financial Intermediary businesses that allow Saxo to provide global market access and cutting edge trading technology to the Industry.

Gaye has over 25 years experience in broking and trading technology and specialises in assisting organisations achieve digital transformation objectives.

Cathie Armour

Cathie ArmourCathie Armour is a non executive director of Cboe Australia. Until June 2022, she was a Commissioner at the Australian Securities & Investments Commission (ASIC) and was a leader in ASIC’s work regulating market infrastructure, market intermediaries and market conduct. Her experience before ASIC was in senior roles at Macquarie Capital and at JP Morgan Australia and in private legal practice. She has extensive experience in the regulation of capital markets and is passionate about their contribution to the success of our financial system.

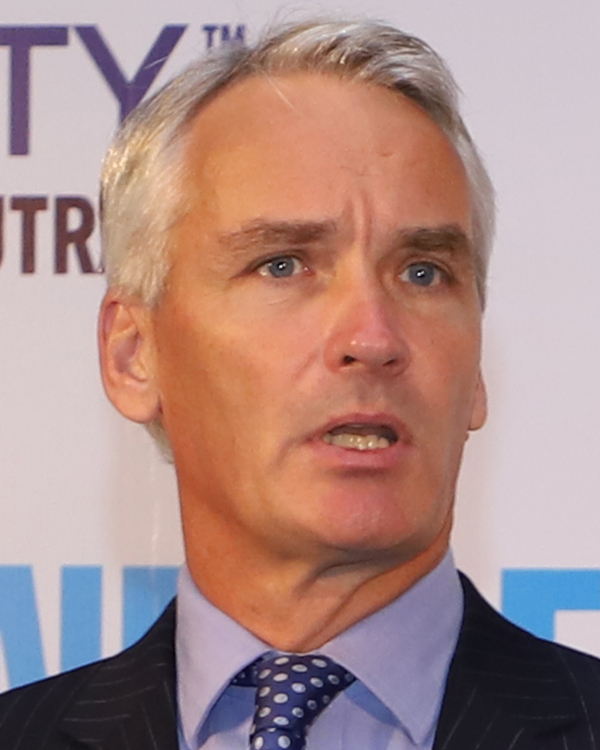

Jeff Bell

Jeff BellAs President and Chief Operating Officer of Eventus, a multi-award-winning global provider of trade surveillance and market risk solutions for financial institutions, Jeff drives the daily execution of several key functions of the business, including Sales Engineering, Regulatory Affairs and Operations. With more than 20 years of experience in financial markets and technology, he has a unique combination of strong management and deep expertise in technology from his previous roles as CEO of Lime Brokerage and Executive Vice President of Clearing and Technology at Wedbush Securities. He has served on the National Securities Clearing Corporation’s Post-Trade Risk Working Committee as well as on various SIFMA committees.

Anson Chow

Anson ChowAnson Chow is a member of Jane Street’s Institutional Sales & Trading team. In this role, Anson focuses on growing the firm’s ETF sales initiatives in the Asia-Pacific region. Anson joined Jane Street in 2019. Previously, he spent 12 years at Deutsche Bank where he worked in Product Development and Sales and Marketing with a focus on institutional client coverage and investor education. While at Deutsche Bank he helped launch DWS Xtrackers’ operations in Asia, participated in expanding its product range on HKEX and SGX, and worked on the project team that delivered the first physical China A-Shares ETF in the US.

Anson holds a BA in Economics from the University of Chicago and an MBA from the Hong Kong University of Science and Technology. With his work having taken him to over 35 cities in Asia, Europe, and the US, Anson enjoys sharing his experiences across a diverse range of cities and cultures.

Dion Cooney

Dion Cooney3 Years at AB | 31 Years of Experience

Dion Cooney is a Vice President and Head of Equity Trading APAC. Before joining AB in 2020, he was a managing director at Virtu Financial, heading the Asia Pac Execution Services team in Hong Kong. Prior to that, Cooney was based in Sydney and New York in various roles for Investment Technology Group over a 19-year period. He is a member of the Markets Consultative Panel for the Australian Securities & Investments Commission and a member of Asia TraderForum. Location: Sydney

Stephen Ead

Stephen EadStephen is the head of product and platform for iShares ETFs in Australia. He is responsible for iShares product management/development and oversight of the day-to-day operations in both the primary and secondary ETF market. Stephen joined the firm in 2002 working in the European Business Development team in London. He moved to Australia in 2007 as a business analyst working on iShares and other operational processes, before moving to iShares in 2012. Prior to joining the firm Stephen worked for Baring Asset Management in London. Stephen has over 25 years industry experience and holds a BA in Economics from the University of Leeds.

Tui Eruera

Tui ErueraWith over 15 years experience in finance and technology, Tui is the Founder and Chief Executive Officer of the award winning and 2022 AFR fast starter company Jaaims, Australia's first AI portfolio manager for retail investors which manages funds for over 5,000 investors in Australia. He also founded Launchr, Australia's first VC fund with a sole focus on early stage investments in the highly coveted Israel hi-tech scene with its inaugural fund raising $25m. Prior to Jaaims, Tui co-founded Livn, an open connectivity hub for creators and sellers of tours and activities, which serves content for Google which he successfully exited in 2016. Tui holds an MBA from Deakin University.

Rob Fowler

Rob FowlerRob played a leading role in delivering trading systems to diverse financial markets such as ICAP, SWX Swiss Exchange, Shanghai Stock Exchange, and the Moscow Interbank Currency Exchange. He managed the interfaces team at NASDAQ for 13 years, taking part in the design and deployment of multiple trading interfaces and related technologies, including FIX Gateways & Protocols. Rob led teams that deployed 19 FIX (Financial Information eXchange) gateways into production and was also involved in the development of an additional 12 gateways using both proprietary and open-source protocols.

In his current role at OSL, he oversees the core exchange platform, focusing on stability, scalability, and security, and is responsible for the implementation and production support of FIX gateways for order management and market data. Rob manages technical solutions for 130 FIX Participants within OSL and has dedicated his entire professional life to the financial markets, with a focus on technical development and implementation.

Richard Galvin

Richard Galvin Richard is the Co-Founder and Chief Executive Officer of DACM. Richard founded DACM in 2017, bringing with him more than 20 years’ experience working in senior investment banking roles including at JP Morgan and Goldman Sachs. Richard is a thought leader and global commentator on the evolution of digital assets and the long-term investment opportunities in this new asset class. As the Co-Founder and CEO of DACM, Richard applies unique investment skills to provide sophisticated and institutional investors access to professionally managed digital asset portfolios.

Soujit Ghosh

Soujit GhoshSoujit is responsible for developing, promoting, and strategizing all Bloomberg Products related to the Equity Derivatives and Structured Product Markets for APAC, including the application of AI & NLP technologies to Equity Derivatives Trading.

Prior to joining Bloomberg in 2021, Soujit worked for 20 years as an Equity Derivatives Trader at several banks in London, Hong Kong, and Seoul, including JP Morgan and Nomura. He began his financial career as an Equity Derivatives Trader at Goldman Sachs in London. In between his trading roles, Soujit also founded an AI driven FinTech startup with seed funding from Alibaba.

Soujit graduated from Cambridge University with BA and MEng degrees in Chemical Engineering. Soujit also studied at Harvard University, where he graduated with a Master’s degree in Statistics.

James Hammond

James HammondJames Hammond has over two decades of experience in the financial services sector spanning across both Europe and APAC.

As the Vice President of Business Development APAC, he assumes leadership for the ANZ sector and is responsible for developing business strategy and sales performance.

James is also spearheading the delivery of Mottai, a wholly-owned subsidiary of FlexTrade specializing in digital trading solutions that redefine user experience, speed, and customisation.

Before joining FlexTrade, James led Wealth business development at LSEG Australia, where he successfully oversaw the transformation of their local wealth offering, ultimately establishing them as the leading solution provider in New Zealand. Furthermore, he managed the team responsible for developing Wealth Order Management, a pioneering multi-asset trading platform exclusively designed for Wealth Advisors, seamlessly integrated into their flagship Refinitiv Workspace platform.

Edward Hassall

Edward HassallEd Hassall is a Trader and Assistant Portfolio Manager within Vanguard Australia’s Equity Index Group.

In this role, Ed is responsible for the execution of equities and futures trades on behalf of all of Vanguard’s global funds across fourteen Asia-Pacific markets. Over the 10 years at Vanguard, Ed has had a number or roles including APAC Equity Execution Consultant and Index Analyst.

Prior to joining Vanguard Australia in 2013, Ed spent 7 years at Goldman Sachs JBWere in their Private Wealth Management division.

Ed is a CFA Charterholder and holds a Bachelor of Business (Economics and Finance) from RMIT University.

Duncan Higgins

Duncan HigginsDuncan Higgins is the founder and CEO of Sustainable Trading, the non-profit membership network supporting the financial markets trading industry to implement improved Environmental, Social and Governance business practices. With 25 years’ experience in financial markets, he held various positions at the agency broker and trading technology provider ITG (acquired by Virtu Financial), took Turquoise from start-up to its acquisition and spent nine years with UBS Investment Bank. Duncan is also a senior adviser to the independent investment bank Liberum.

Richard Hills

Richard HillsRichard Hills is Head of Client Engagement at big xyt and the strategy lead on the JSE Trade Explorer data analytics project, which is now under the direction of big xyt ecosystems, the new joint venture between the Johannesburg Stock Exchange (JSE) and big xyt.

Richard has over 30 years’ experience in capital markets, and before joining big xyt, he established and ran the electronic trading business at a major European investment bank before becoming managing director of the global equities execution team.

Prior to that, Richard trained as a systems engineer with IBM before joining Accenture as a consultant in financial markets.

Saskia Kort-Chick

Saskia Kort-Chick Saskia Kort-Chick is a Senior Vice President and AB’s Director of ESG Research and Engagement for the Responsibility team, where she leads AB’s global efforts to further enhance investors’ ability to integrate social issues into their decision-making and investment processes. Kort-Chick has been leading AB’s work on modern slavery, which has been recognized with the Themis International Services 2021 and 2022 Combatting Modern Slavery Award; the Environmental Finance Sustainable Investment Awards 2022 ESG Assessment Tool of the Year, Risk and Reporting Award; and was a shortlist for the PRI’s 2022 Stewardship Initiative of the Year Award. She herself was also shortlisted for the International Corporate Governance Network Rising Star Award in 2022. Kort-Chick is also responsible for the development of ESIGHT, AB’s ESG research and collaboration platform, and chairs the ESIGHT Steering Committee. She co-chairs the APAC Responsibility Steering Committee and is a member of both the Controversial Investment Advisory Council and Proxy Voting and Governance Committee. She participates in many industry organizations, including Investors Against Slavery and Trafficking Asia Pacific, PRI’s Advance and Asia Corporate Governance Association. Prior to joining AB in 2010, Kort-Chick worked for investor relations consultancy RD:IR as a senior account manager. She holds a BA (cum laude) in social sciences from University College Utrecht, Netherlands; an MA (with merit) in war studies from King’s College London; a postgraduate certificate in management (with a focus on corporate responsibility) from Birkbeck, University of London; and an Investment Management Certificate (IMC) from the CFA Society of the UK. Location: Melbourne

Jason Lapping

Jason LappingJason Lapping heads Dimensional’s International trading team, with twelve traders located in London, Singapore and Sydney. His focus is on ensuring the firm's execution strategies and technological infrastructure meet the highest standards.

Originally from South Africa, Jason studied economics at the University of Cape Town before moving to London to start his career in the financial sector. Jason joined Dimensional in 2010 and brings deep knowledge and experience of global markets, including the unique microstructure of those in the Asia Pacific region. This experience was garnered over fourteen years working around the world with Societe Generale in their equities derivatives division, and heading desks in London, Paris, Hong Kong and Australia.

Jason reports to Ryan Wiley, Head of Global Equity Trading.

Jessica Leung

Jessica LeungJessica Leung is a Portfolio Manager at Global X ETFs, responsible for fund management, product development and collaborates with the broader business to enhance systems and processes. Jessica works across Global X’s full suite of products including equity, thematic, commodities and fixed income. Prior to joining Global X ETFs, Jessica has worked at BetaShares and Macquarie Asset Management, and has close to 10 years of industry experience. Jessica holds a Bachelor of Actuarial Studies and Bachelor of Applied Finance at Macquarie University.

Steve LoGalbo

Steve LoGalboAs Director of Product Management for the NICE Actimize Financial Markets Compliance division, Steve LoGalbo looks after the SURVEIL-X Platform, Markets, Suitability and Communication surveillance solutions in the Holistic Trade Compliance portfolio.

This portfolio consists of solutions for trade and communications surveillance, plus automating compliance tasks using workflow management and automation. Steve’s 15+ years of expertise is with compliance technology, advanced analytics and machine learning solutions that enable financial services organization to be compliant with global regulations and to detect even the hardest-to-find forms of market abuse and conduct risk.

Liam Madden

Liam MaddenLiam has been General Counsel, Asia with Instinet since 2016, having moved back to Australia from Hong Kong, where in 2008 he was appointed Instinet’s regional Head of Legal and Compliance. He is a member of the regional Executive Committee and responsible for Instinet’s regional legal and compliance functions.

A practising lawyer for over 25 years, prior to joining Instinet, Liam worked in private practice as an insurance and commercial litigator before moving in-house with CMC Markets in Sydney.

Liam holds a Bachelor of Arts, Bachelor of Laws and Masters of Business Law from the University of Sydney. He is admitted as a solicitor of the Supreme Court of New South Wales, the High Court of Australia and the High Court of Hong Kong. He is a director of Stockbrokers and Investment Advisers Association and Member of the Law Society of NSW.

Edward Mangles

Edward ManglesEdward Mangles has helped support The FIX Trading Community’s Asia Pacific committee for the past over 20 years, playing a key role in promoting institutional trading standards and FIX adoption across the region, and facilitating cross-industry collaboration. In March 2009, Edward was appointed Asia Pacific Regional Director for the FIX Trading Community, and works closely with the buyside, sellside, regulator, exchange and technology provider members of the institutional trading community to support efficient trading.

Alistair Mills

Alistair MillsAlistair is a member of the Betashares Distribution team, responsible for managing the Institutional and Intermediary Broker channels, as well as supporting the firm’s capital markets activities.

Prior to joining Betashares, Alistair was based in London, working at European ETF provider Lyxor Asset Management, where he managed client relationships and due diligence for Northern Europe.

Alistair holds a Bachelor of Mechanical Engineering with Honours from The University of Manchester.

Bridget Nichols

Bridget Nichols Bridget is a business development specialist and financial markets lawyer, with 20 years’ experience in building commercial, operating and regulatory frameworks for new businesses/products in the financial markets industry. She founded Primrose Advisory in 2022 and focuses on advising institutional clients on business growth and strategy-based assignments. In 2023, she has advised on the product launch of 6 innovative ETFs on the ASX.

Prior to Primrose Advisory, Bridget has held business leadership roles at ETF market-making firm Nine Mile Trading, exchange operators in Australia and Europe (ASX, Chi-X Europe) and Institutional Banks in APAC, Europe and America (UBS, State Street).

Bridget holds a Bachelor of Business (with distinction) and a Bachelor of Laws (Honours) from QUT.

Graham O’Brien

Graham O’BrienGraham is a leader in the finance industry with 25 years’ experience in equity and equity derivative markets. In his current role at ASX, he leads a team that innovates on products and services to drive the Australian market forward and bring financial success to clients and companies. He also does many expert and public presentations for the ASX. He has the ability to quickly get a beginner familiar with market jargon and understanding the marketplace.

Murrough O’Brien

Murrough O’BrienMurrough is Head of Cboe BIDS APAC. He is responsible for spearheading the expansion and growth of BIDS Trading across the region.

In his previous role at Cboe Australia, Murrough was Head of Institutional Sales, responsible for growing the institutional footprint of the firm’s Australian operation as well as managing existing Institutional and market making participants. Cboe Australia is a cutting-edge securities and derivatives exchange, which has transformed the Australian investment market through a focus on customers, innovation and value.

Murrough has worked in the industry for over 20 years in New York, London and Sydney and has a broad depth of experience in electronic trading, block trading, market micro-structure, algorithmic trading and technological innovation within equities markets. Prior to Cboe Australia, he ran Liquidnet Australia and before that Head of Electronic Execution for Australia and NZ at Citigroup where he helped steer the franchise through the market integrity rule changes that allowed multiple markets in Australia.

Yemi Oluwi

Yemi OluwiYemi has over 20 years' experience in financial markets, specialising in electronic trading. At NSX he is responsible for the operation of the market and the technology strategy of the NSX, and its implementation to deliver business objectives. Roles prior include providing solution analysis and FIX expertise for ASX and implementing electronic trading solutions for Deutsche Bank and UBS.

Mary-Anne Peril

Mary-Anne PerilBased in Sydney, Mary-Anne oversees Virtu’s Execution Services in Australia. She shares her insights and expertise in executing high-touch, electronic and program trades for our institutional buy- and sell-side clients, based both locally and offshore.

Mary-Anne joined ITG in 2004–prior to the firms’ 2019 acquisition by Virtu Financial.

Mary-Anne holds a Bachelor of Arts, with majors in Mathematics and Statistics from The University of Melbourne, and a Master of Applied Finance, majoring in Financial Markets, from Kaplan Professional.

She won the Excellence in Sell-Side Trading Award at the 2020 Women in Finance Asia Awards.

Ross Pullen

Ross PullenRoss Pullen leads product development efforts to launch new markets at Cboe Australia, joining the organisation in October 2015. Prior to joining Cboe Australia, Mr. Pullen led the AQUA team at the Australian Stock Exchange where he was responsible for ETF, Managed Fund, Hedge Fund & Warrant markets and ASX BookBuild. His background includes >16 years stock exchange experience and uniquely, he either led or was a member of teams which launched both of Australia’s ETF markets.

Emma Quinn

Emma QuinnEmma Quinn is President, Cboe Australia at Cboe Global Markets, Inc. (Cboe). A proven leader with significant experience in global capital markets, she is responsible for defining and executing the company’s strategy and increasing adoption of its products and services.

In 2023, Quinn joined Cboe from AllianceBernstein, where she was Global Co-Head of Equity Trading. Previously, she served as head of Asia-Pacific Trading, head of Asia-Pacific Fixed Income and Australia Equities Trading, and head of Trading for Australia and New Zealand for the firm. Prior to joining AllianceBernstein in 2001, she worked as an equity trader at AMP Henderson Global Investors.

Quinn also provides strategic leadership and participation on a number of boards and committees to help drive innovation and influence industry development. She is currently a Director and Chairperson of FIX Protocol Limited and FIX Protocol Trading Limited boards. She was previously an advisory board member of Quorum 15; a member of the Markets Advisory Panel for the Australian Securities and Investments Commission; a member of Asia Trader Forum; and a member of various Asia Securities Industry & Financial Markets Association committees.

Quinn holds a Bachelor of Business in finance and business law from the University of Technology, Sydney.

David Rabinowitz

David RabinowitzDavid Rabinowitz is Head of Global Index Analytics and Asia Pacific Market Structure.

David started his career at SBC Warburg in 1997, where he assisted in designing and implementing Warburg's European Equity Research database. After a brief stint at Paribas, he moved to Hong Kong to rejoin UBS Warburg Dillon Read in 2000, as a member of the award-winning Asian Quantitative Analysis team. David then moved on to the Asian Portfolio Trading team between 2004 and 2008 before leading the Asian electronic trading desk over the past decade, managing the rollout and expansion of UBS' DMA and Algorithmic strategy platform throughout Asia. David relocated in 2018 to Sydney where he continues to oversee regional market structure and emerging market access, driving exchange and regulatory trading initiatives whilst concentrating on building benchmark and bespoke beta solutions for global clients.

Mark Randall

Mark RandallMark Randall is the Director of Information Services at the Johannesburg Stock Exchange (JSE), the largest stock exchange in Africa. The JSE operates two cash markets and four derivative markets in South Africa, and the Information Services team under his leadership is responsible for the data assets of the Exchange across all six markets, including regulatory, real-time and end of day data.

Mark has over 15 years’ work experience in the data arena at the JSE. His experience spans market data licensing, data analytics and quantitative pricing, as well as reference data, indices, risk management and data governance. Mark is a member of the Actuarial Society of South Africa and the Institute and Faculty of Actuaries, and is an active member of the investment actuary community in South Africa.

As Director of Information Services, his mandate and passion is to revolutionise the way that the JSE thinks about its data assets and data strategy to entrench a modern data capability within the exchange and uncover new revenue opportunities for the exchange.

Glyn Roberts

Glyn RobertsGlyn Roberts runs JP Morgan’s Australian Delta One and ETF trading desk. Glyn is responsible for providing OTC and screen liquidity to institutional clients across a variety of delta one products with a particular focus on ETFs, futures and swaps.

Prior to joining JP Morgan in 2020, Glyn ran a similar desk at Deutsche Bank in Sydney from 2009 through 2019.

Glyn holds Bachelor degrees in Engineering and in Computer Science from the University of Melbourne and a Masters in Applied Finance from Macquarie University.

Adam Rubinsztajn

Adam RubinsztajnAdam is a member of the Coinbase Institutional Sales team based in Singapore. Prior to joining Coinbase, Adam was head of Hedge Fund Sales and eFX Sales for Natwest Markets in APAC. Before that, he started his career at State Street Global Markets, where he marketed a range of Fixed Income and Foreign Exchange products and derivatives. Adam received his Bachelor’s of Science in Finance from the University of Maryland, College Park and is a CFA charterholder.

Damien Sherman

Damien ShermanDamien has been building and commercialising ETFs since 2011. He has held senior product and capital markets roles with some of the largest ETF issuers in the world. At JP Morgan Asset Management, Damien is responsible for developing and managing the suite of 9 Active ETFs. Prior to JP Morgan Asset Management he held roles at Intercontinental Exchange, Janus Henderson and Vanguard. In developing ETFs, Damien has worked closely with market makers, exchanges, operations and ETF investors.

Tarinee De Silva

Tarinee De SilvaTarinee is a Founding Principal at Barrenjoey and has 11+ years of Australian Markets experience, specialising in Electronic Sales & Trading. Tarinee joined Barrenjoey in 2021 to help build the Electronic Execution Platform and is actively involved in the development and release of Barrenjoey’s algo suite and client coverage. Prior to Barrenjoey, Tarinee spent 9 years at Macquarie Bank.

Andrew Templer

Andrew Templerdrew leads ASIC's market conduct supervision teams, responsible for supervising market intermediaries’ compliance and conduct, and monitoring the distribution of complex products. He has held leadership roles in ASIC’s Markets group since 2009.

Andrew has 20 years of experience in financial services, regulation and law and holds a Bachelor of Commerce and Bachelor of Laws from Monash University.

Lisa Wade

Lisa WadeLisa is the CEO of DigitalX. DigitalX is a blockchain financial company innovating at the frontiers of Web3.0. with a sustainable focus via a commitment to the WEF ESG and Stakeholder Capital framework and RegTech innovations such as Drawbridge.

Lisa has over 29 years of experience in the finance industry including co-founding Australia's first Low Carbon Fund in 2007 and Change Investment Management in 2009. As a proven pioneer of the socially responsible and impact investment industry, she has established a reputation for driving superior investment returns from the economic opportunity of the transition to a low carbon economy.

Lisa is also an ambassador for Earth Hour and Al Gore's Climate Reality Leaders initiative as well as a Mentor for AYP and current holder of the Blockie for Gender and Diverse Blockchain leader of the year - as an out member of the LGBTI+ community Lisa is an advocate and example of equality in action.

Lisa passionately believes investors should no longer have to compromise their values for their investments and with technology and de-fi will be able to truly align their values to their investments. She is also using new technologies to promote equity and equality across financial landscapes via her work exploring the tokenisation of impact.

Lisa has multiple years experience managing international portfolios in both De-fi and trad-fi assets. During her career Lisa has been a Director at Citigroup where she specialised in arbitrage and derivatives and Head of Digital innovation and sustainability at NAB. Lisa is an experienced trader with an in-depth understanding of pricing and investing in derivatives and financial products. In her role as head of Community Assets at Bendigo Bank Lisa specialised in developing financial structures to facilitate the acceleration of impact investment, including community micro-grid investment models, co-founding the Bright Energy fund, an early stage investment in Future Super and co-creating RARI - Australia’s first responsible investment ETF.

Lisa has a Bachelor of Business majoring in accounting and finance. In 2011 Lisa completed a Post-Graduate certificate in Shariah Compliant Investing at LaTrobe University, Melbourne.

Jeff Yew

Jeff YewJeff Yew has been involved in the crypto-asset markets since 2013. In 2021 he founded Monochrome to solve an industry problem of a lack of regulated access and secure custody for crypto-assets within traditional finance structures.

Monochrome is an asset manager that specialises in providing investment management services for eligible crypto-assets within regulated structures for Australian markets. Jeff is Monochrome’s CEO and is also a member of its Governance Committee.